A few days back, the Chess World witnessed a very interesting performance – 5-time world champion Viswanathan Anand beating another 5-time world champion Magnus Carlsen after a 5-year gap to take his score to 5 in the tournament! As chess is more about strategizing, planning, and executing, you might think this is yet another article on trading plans, but no. A lot has been discussed about trading plans, sticking to your plans, etc. and so today, based on the above news, I would like to discuss something quite different with you.

Rising from the ashes

With the above-mentioned victory, Anand is once again proving that age, setbacks, etc. are all temporary and that if you have a never-say-die attitude and resilience, you can spring back up from any adversity. After losing his World Championship title to Carlsen, experts in the game thought it was time for Anand to retire and focus on imparting his skills to the next generation. But he proved them all wrong with his unbelievable comeback, made possible by his attitude and resilience. To rise like a phoenix bird from a poor run requires an uncanny ability to endure failures whilst keeping a healthy outlook.

Tigers Crouch To Leap Forward

However, this theory stretches far beyond the game of chess. It applies to stock/forex traders too. At times, we will suffer some, no matter how good we are performing in our trades. What most people do at this point is to quit, which is the most obvious and easiest thing to do. But smart traders and winners never quit. Just like Anand, who is well known as the Madras Tiger, they may take a few steps backwards, only to bounce back with unrivalled brilliance. The steps that they take backwards can be likened to the crouching of a tiger, which is nothing but a preparation for leaping on its prey later.

Now why was Anand able to do this? Because of his power to endure setbacks. This is a power that all traders must cultivate at any cost. Don’t panic at the sight of a couple of losing trades. Understand that it is not just the trading skill that matters in winning in forex trading. There are a lot of other factors too. And so it would be wise to take a step backward and sit and analyse why your trades are not turning out to be as good as you expected them to be.

Cultivating Emotional Endurance

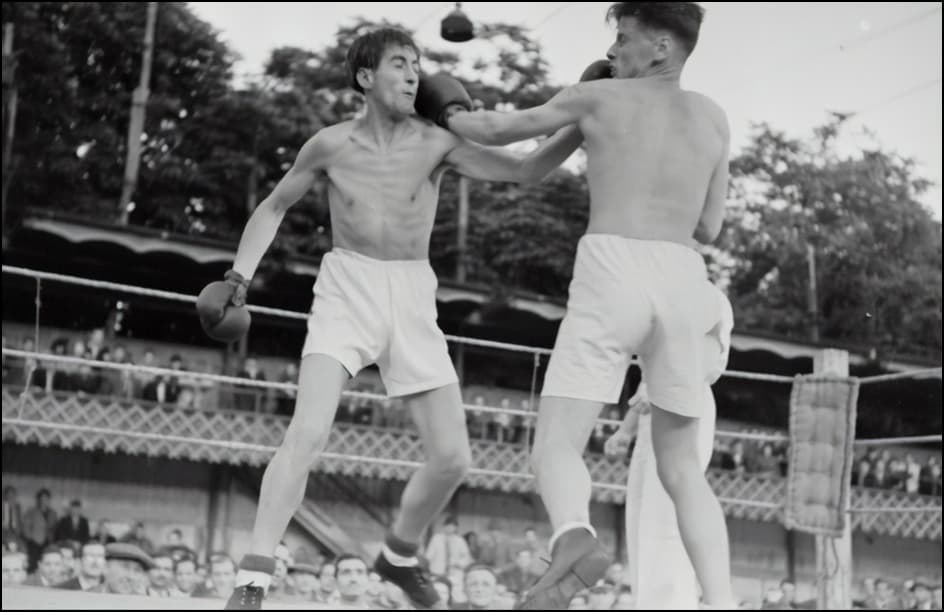

Another living legend, Mike Tyson, once said, “Everybody has a plan until they get punched in the mouth. Then, like a rat, they stop in fear and freeze.” This quote is applicable not just to boxing, but to life in general.

This is very true in stocks/forex trading. The moment they face a loss, many traders drop their trading plan and start trading on emotions. Traders need to understand an important point here – it is not the loss that determines your success, but the way you react to the loss. Losses are unavoidable – whether it be trading, business, or anything. But it is losing your emotional balance and confidence that leads to further losses. This can nevertheless be avoided by building emotional endurance. With endurance, you take losses in the right spirit and boldly move forward with confident steps.

In the game of boxing, it is not just about punching your opponent or eluding his punches – it is also about taking the punches of your opponent like a man, enduring it, without falling off to the ground. Similarly, in trading, you should face losses boldly, take them like a man, and endure them without losing your confidence.

However, this does not mean that you should simply face losses and do nothing to stop them. As mentioned earlier, it is how you respond to the losses that define your future success. Responding to losses very much include, beyond enduring them, identifying your problem areas and working on them. However, this step would not be possible unless and until you have that much-needed ability to endure the losses.

Now, think about the last time you faced a setback and analyze how you responded to it. Were you able to bounce back? If not, try implementing the points discussed above.

In short, the key is to treat any setback as just another opportunity for a comeback. It does not happen overnight. But with a focused effort, you can build that muscle and flex it to gain optimum advantage