Mastering Risk Management and Embracing the Power of One

In the world of forex trading, enthusiasts often embark on their journey with a fervent desire to cultivate every conceivable quality of a successful trader simultaneously. They diligently study market trends, immerse themselves in technical analysis, and attempt to master intricate trading strategies. However, this approach often leaves them overwhelmed and disheartened, as they grapple with the challenge of trying to nurture numerous habits all at once, without realizing the power of one.

As a result, traders – whether stock traders or forex traders – may find themselves in a tangled mess, wondering how to navigate the complexities of the forex market. It is at this juncture that the wisdom of one of Chanakya’s famous quotes comes into play – here is the quote:

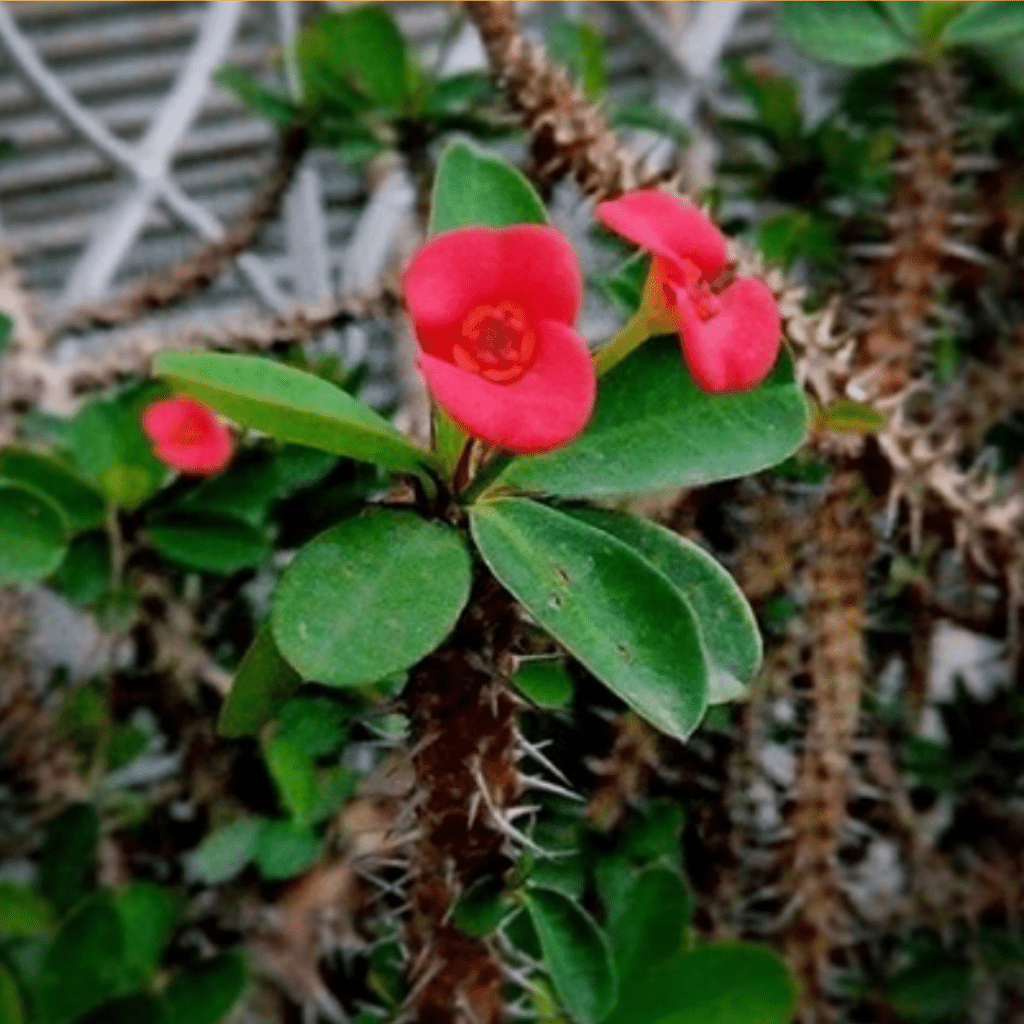

“A thorny bush is a shelter of snakes, is imperfect, is full of thorns, its shape is curved, grows in slush and it is dangerous and difficult to approach (for its flowers). But still its only one virtue of friendship with essence (having fragrant and beautiful flowers) destroys all its defects.”

Courtesy: www.freepik.com/

In a similar vein, all challenges associated with achieving a consistent profit in trading can be surmounted by nurturing a single quality. That lone virtue that can truly overshadow all imperfections in forex trading is risk management. Just as the fragrant flowers of the thorny bush can negate its inherent dangers, effective risk management can transform a trader’s experience. Understanding how to assess and manage risk is the cornerstone of success in the forex market.

Proactive Risk Management

To make the most of managing risks in trading, it’s not enough to just learn about it. You have to use this skill in every part of your trading. This means you need to keep asking yourself important questions, like “What could go wrong if I decide to stop my trade at a certain point?” or “What risks do I face if I use this trading plan in the current market?”

Courtesy: www.freepik.com/

By asking these questions regularly, traders can protect their money and make smart choices that match their comfort level with risk and what they want to achieve in trading.

In the world of trading, where markets can change suddenly, knowing how to handle risks is very important. It’s like having a compass that helps you navigate through uncertain times and reach your trading goals safely and carefully.

Multi-Faceted Approach to Mastering Risk Management

To truly excel in the complex world of forex trading, it’s essential to master the art of risk management. This skill can be honed in several ways, making it accessible to traders at various levels of expertise. By diversifying your approach, you can become adept at handling risks effectively, ultimately paving the way for a successful forex trading journey.

Educational Resources: One fundamental step in mastering risk management is to immerse yourself in educational resources. This includes reading books and articles, which provide valuable insights into trading strategies, market analysis, and risk mitigation. These resources are readily available and serve as the bedrock of knowledge for traders looking to understand the intricate web of forex trading.

Specialized Course: Specialized courses are another avenue to explore. These courses offer in-depth knowledge, tailored strategies, and real-world examples that can bolster your risk management skills. They often provide a structured learning environment and an opportunity to interact with seasoned professionals, which can significantly accelerate your learning curve.

Experienced Mentors: Seeking guidance from experienced mentors is a priceless treasure. A mentor can share their wealth of knowledge, guide you through market intricacies, and provide practical tips. They can help you navigate challenges by sharing their own experiences, helping you avoid common pitfalls, and offering constructive feedback.

Self-Reflection: Reflecting on your own trading experiences is equally crucial. Every trade you execute is a learning opportunity. By analyzing your past trades, both the successful and the less so, you can identify patterns and trends. This self-reflection allows you to fine-tune your risk management approach, adapting it to your trading style and risk tolerance.

Essence of Risk Management

By continuously refining your risk management skills and implementing them consistently in your trading, you can unlock the essence of success in the forex market. In conclusion, the essence of prosperous forex trading lies in understanding the potential of this one key quality. Just as the sweet essence of flowers overshadow the negative qualities of the thorny bush mentioned in the quote, this single skill has the power to help you overcome the challenges in trading and ensure a consistent stream of profits.

Risk management, when mastered and integrated into every aspect of trading, becomes the essence of forex success. It not only mitigates the inherent challenges of the market but also empowers traders to navigate the forex landscape with confidence, resilience, and the promise of consistent results. So, embrace the power of one, master risk management, and let the essence of forex success await you on your trading journey.