I did say NO to overtrading when I incurred a loss the other day, but I dunno what prompted me to go for it and end up incurring further losses!” This is a statement that I often hear from my clients when asked about why they were not able to contain their temptation to trade out of emotion. Most of my clients intellectually understand the ramifications of emotional trading and over-trading, but only very few are able to bring that wisdom into their trading desk. Why does this happen despite saying NO at the very onset of such a desire in their minds?

The answer is very simple. They were not able to say NO for the second time – and it is the second NO that decides what happens at the trading desk. It is easy to grasp the logic behind the advice against emotional trading or over-trading. It is also easy to say NO when the first persuasion springs up in your mind to trade based on your emotions. However, that desire won’t just go away like that with a single NO. It will keep coming back to you, knocking loudly and repeatedly at the door of your mind. And that is where the second NO becomes decisive.

In most cases, traders are not able to say that second NO because they are unaware of the source of that repeated persuasion. Therefore, the antidote to this whole issue lies in understanding the source of the desire to do emotional trading.

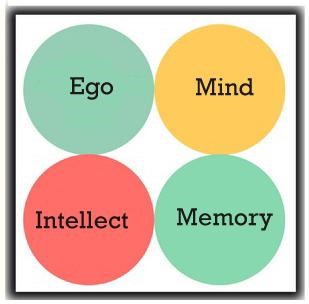

Broadly speaking, the impetus to trade along emotional lines originate from four sources; viz. The Ego, The Memory, The Mind, and The Intellect. Collectively called the Internal Faculties, they influence every decision you take while you are at your trading desk. I will take you through all four of them and help you understand how to manage the desires arising from them.

The Ego

We all have the desire to win, put up a good performance, etc. We often expect situations to fall into our Favour. We have a desire to feel good about ourselves. All these emanate from the same source – The Ego. Such desires have a strong influence – both favorable and unfavorable – on our trading too. So when you feel that urge to trade out of emotion, check whether the desire is anything related to those mentioned above. It may be the urge to overtrade to continue your winning streak or to cover the shame of the loss you suffered in your previous trade. In such cases, reassure yourself that you need not win a trade to feel good about yourself. Your worth, your skill, etc. are not determined solely by profit. Profit or loss is decided by various factors and that has no relation with your worthiness. This realization will help you to discard all such desires by saying an emphatic NO for the second time.

Courtesy: www.freepik.com

The Memory

All your experiences are stored in your memory. So when you make two winning trades in a row, a desire may emanate from your memory telling you that you’ve had similar winning streaks in the past and therefore you can go on and on. This is seldom true. It depends a lot on the market situation, your style of trading, the capital that you have, etc. So remind yourself that the previous winning streak that you have in your memory well stored and preserved was under totally different conditions and that it is preposterous to go on and on without paying enough attention to the current market condition, the funds that you have at your disposal now, and other factors that decide the outcome of the trade. Such a reminder will help you to say that most important second NO.

Courtesy: www.freepik.com

The Mind

You will have a lot of financial goals for the month or year. And that may be playing at the back of your mind. So when you incur a loss, a desire to overtrade may spring up from your mind reminding you about your financial commitments or goals for the month. In such cases, be very clear that it is not the size of your immediate financial need that determines whether you should take the next trade or not, but the market situation, your skills, money management ability, risk involved, etc. that determines it. Shifting your focus from the desires of the mind to the market situation will automatically prompt yourself to say NO for the second time.

Courtesy: www.freepik.com

The Intellect

Intellect is your all-time friend. It is the faculty of the mind that helps you to pick from various available options. Persuasions arising from the intellect seldom take you through the wrong route. Therefore, if you perceive the market situation as unfavorable to your style of trading and money/risk management skills, then you need not think twice to say that decisive NO. Sticking to the opinion of the intellect when practiced over time would help you gain enough strength to reject persuasions from all other internal faculties and takes you a long way forward in your trading journey.

Courtesy: www.unsplash.com

In this manner, if you check the source of the desire that is prompting you to overtrade, then you will realize how illogical, how misplaced, and how irrelevant those desires are. This realization will help you to say the game-changing second NO!